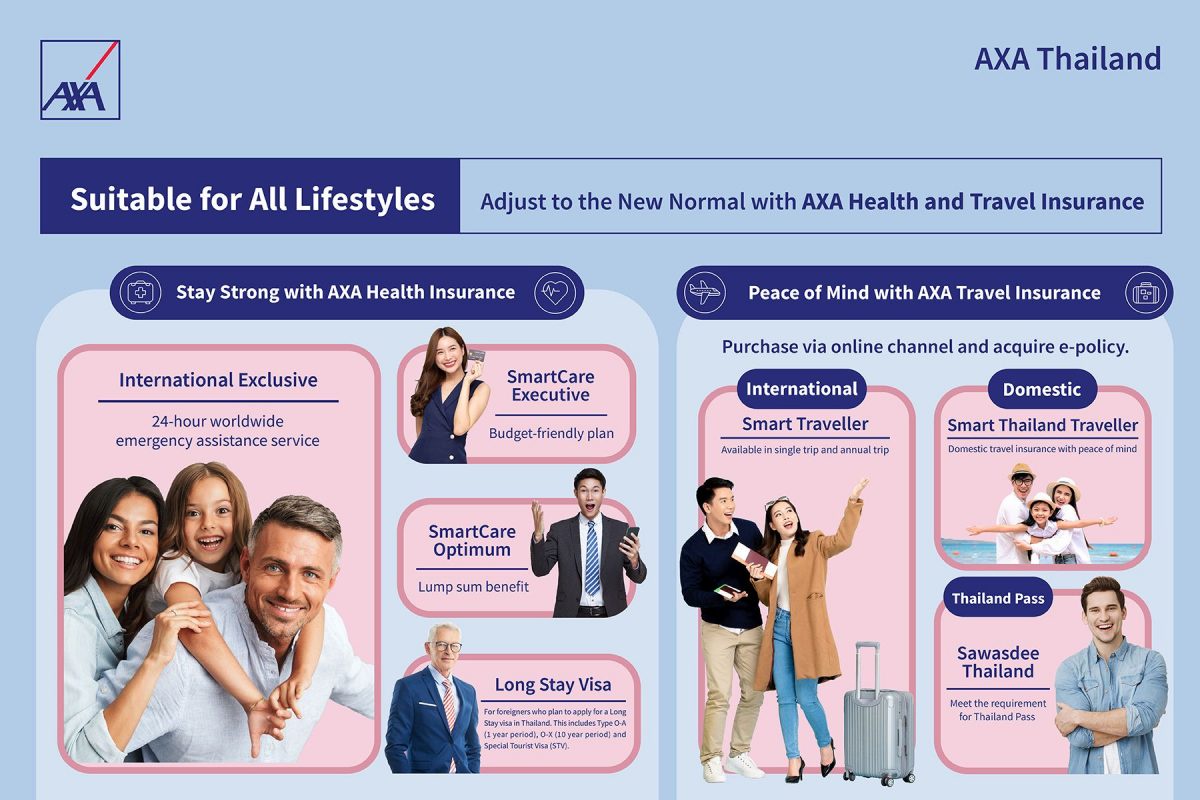

AXA Thailand General Insurance has four health and three travel insurance offers to fit all lifestyles. With different policies designed to suit different stages of life and lifestyle, insurance coverage provides confidence when the unexpected occurs. AXA Insurance accompanies customers throughout their journey, providing them with a stress-free future.

AXA's Health Insurance Provides Comprehensive Coverage

- AXA SmartCare Executive offers coverage for medical expenses and inpatient treatment. What makes it stand out in the market is the affordable premium that provides coverage for outpatient kidney dialysis in case of chronic renal failure, and cancer treatment. Customers can choose to purchase outpatient coverage for up to 2,500 baht per day. The policy offers lifetime renewal until the customer reaches the age of 99. A no-claim bonus will be offered upon renewal.

- AXA SmartCare Optimum is designed for customers who are concerned about the increasing high costs of medical fees. The plan provides high coverage, up to 20 million baht per year, and pays medical expenses as charged*. A lump sum benefit for illnesses like cancer, coronary artery disease requiring surgery, including myocardial infarction, is covered as soon as the disease is detected and confirmed by the doctor. Moreover, this plan includes prosthesis and organ transplant benefits* and medical emergency expenses coverage for international travels of 90 days per trip.

- AXA International Exclusive is an all-inclusive plan that offers one of the highest levels of local and international coverage in the market, with a benefit amount of up to 93 million baht per year. The plan provides daily compensation of up to 7,500 baht and coverage for alternative treatments* such as acupuncture, traditional Chinese medicine, homeopathy and psychiatric treatment. Additional coverage* can include maternity, health checkup, vaccination, dental and optical care. This includes annual deductible options with up to 25% discount on premium, and provides 24-hour worldwide emergency assistance service.

- AXA SmartCare Executive - Long Stay Visa is ideal for foreigners who are applying for or renewing a Long Stay visa in Thailand. This includes Type O-A (1 year period), O-X (10 year period) and Special Tourist Visa (STV). The highlight of this personal health insurance is that for O-A and STV non-immigrant visas, coverage is offered for up to 4.5 million baht per year. Moreover, discounts will be provided for family purchases and for customers with no-claim bonus at renewal. This includes annual deductible options with up to 50% discount on premium.

With an extensive range of coverage to AXA's insurance policies, the health insurance plans also provide medical coverage for COVID-19*. Through AXA's network of over 400 hospitals nationwide, customers can be sure that their needs are met.

AXA's Travel Insurance, Providing Coverage Anywhere and Anytime**

- AXA Smart Thailand Traveller is an insurance plan for domestic travel. Customers can choose the insurance plan to suit their travel dates, with premiums starting at 41 baht. An accidental coverage of 1 million baht is provided in case of death or disability of the insured, including vehicle and motorcycle accidents.

- AXA Smart Traveller Plus is an international travel insurance with a variety of options. The single trip option offers coverage for up to 5 million baht for travel of 180 days, with a premium starting at 186 baht per day. The annual option is ideal for frequent travellers as it offers an unlimited number of trips but not exceeding 180 days per time, with an annual premium starting at 1,500 baht. For peace of mind, insurers will be compensated in case of trip cancellation. This insurance plan is accredited by embassies of the countries in the Schengen zone; customers can apply for visas in one of these embassies with a 100% refund in case of visa rejection.

- AXA Sawasdee Thailand is suitable for foreigners planning to travel to Thailand. This insurance plan meets the official requirements for "Test and Go Thailand Pass" and "Sandbox Program." Coverage starts immediately after clearing immigrations in Thailand. AXA Sawasdee Thailand provides medical expenses in case of positive test results for COVID-19*. Coverage of 1.75 million baht for medical expense including COVID-19 and 1 million baht for personal accident is included. No waiting period, no deductible, no advance payment for hospitalization if required.

For more information about AXA's Health Insurance and Travel Insurance

Contact us through:

- AXA website https://www.axa.co.th/th/

- AXA Customer Service, call 02-118-8111

- Facebook AXA Thailand https://www.facebook.com/AXAThailand/

- Line @AXAThailand

*The insured must read and understand the terms and conditions before making decision.

**The policy will not cover any loss, injury, damage, or legal liability arising directly or indirectly from travel in, to or through the specified countries and provinces.

Source: Francom Asia