SET President Pakorn Peetathawatchai said that SET in 2022 tightens market surveillance measures, aiming to bolster effectiveness of the oversight for stock market in an appropriate manner and protect investors against risks in a more immediate manner.The tougher measures are in accordance with SET's counterparts.

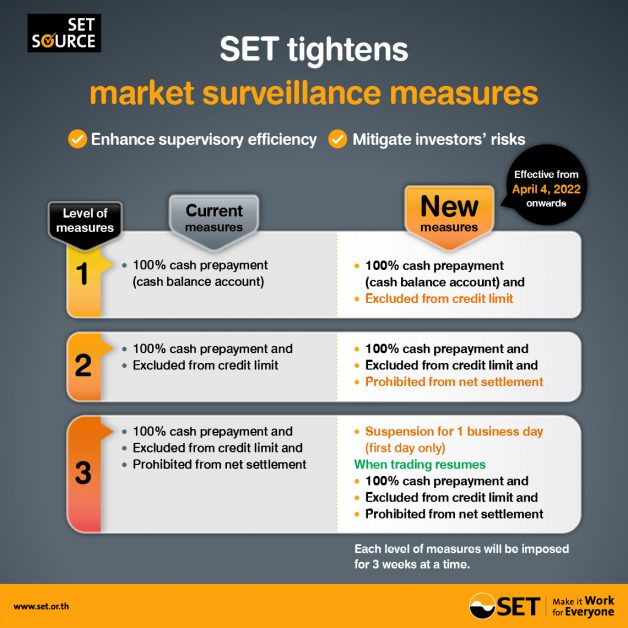

The new set of market surveillance measures is as follows:

Current measuresNew measuresLevel 1: 100% cash prepayment (cash balance account)Level 1: 100% cash prepayment (cash balance account) and Excluded from credit limitLevel 2: 100% cash prepayment andExcluded from credit limitLevel 2: 100% cash prepayment andExcluded from credit limit and Prohibited from net settlementLevel 3: 100% cash prepayment andExcluded from credit limit and Prohibited from net settlementLevel 3: Suspension for 1 business day (first day only) When trading resumes: 100% cash prepayment and Excluded from credit limit and Prohibited from net settlementEach level of measures will be imposed for 3 weeks at a time but SET can extend the implementation period or tighten measures if irregular trading activities still prevail.

SET strongly urges investors to thoroughly study information of securities subject to market surveillance measures including financial status, operating performance, risks and other relevant factors as well as trading conditions before making investment decisions.

For information about the amended market surveillance measures, please visit www.set.or.th, go to topic "Rules/Regulation" and "Regulation - Circular Letter - Trading & Supervision".

Source: SET Corporate Communications