The bank has also been trusted by the Community Fund Committee under the Community Development Department, Ministry of Interior to deliver the TANG-TO-KNOW-HOW programme to their employees to upskill their financial literacy knowledge. The training programme will be used to enhance skills in managing community funds and to promote savings amongst. The financial literacy focus for the public is in line with the core mission of the Saving for Production Group, of the community Development Department.

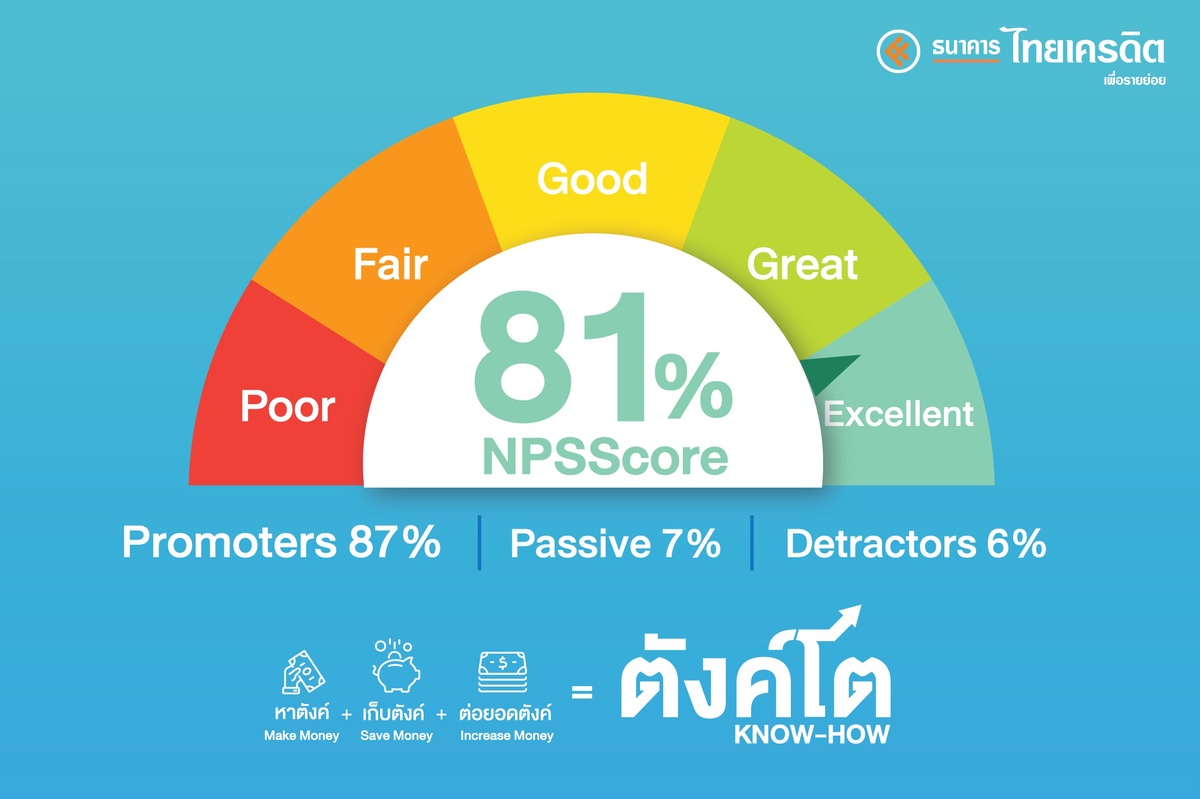

In this recent financial literacy programme, participants included members of the Community Fund Committee, experts from the Saving for Production Group, group directors and development officials, provincial officials in charge of community funds, developers, and Saving for Production Group school committee representatives from 76 provinces who would, in turn, transfer financial literacy to their constituents across the country. 81 percent of the participants were pleased with the speakers, their teaching techniques, and course content. Participants felt the programme was fun, easy to understand, and practical. Additionally, participants said they would promote the programme by inviting others to join Thai Credit Retail Bank's financial literacy programmes in the future.

Mr. Roy Agustinus Gunara, Managing Director of Thai Credit Retail Bank Public Company Limited said that through the Tang-To-Know-How programme, Thai Credit Retail Bank is determined to promote financial literacy, particularly focused on financial planning, savings management, household debt management, and financial risk management in crisis, to small businesses and salaried employees.

"A solid base of financial literacy and understanding will allow participants to make better financial decisions in the future, further empowering people to lead more enriching lives," said Mr. Gunara.

The teaching format in 2022 will continue to be online and on-the-ground as COVID restrictions lift. In the second quarter, the bank will also conduct the training sessions to small business owners and people in all regions of the country by transforming Thai Credit Bank lending branches into 264 Thai Credit Bank learning centers nationwide. Thai Credit Bank is committed to promoting financial literacy and financial discipline among small business owners and people continuously. This year, the bank has improved the program to make it more intensive and focus on providing small business owners and people the opportunity to apply what they learn, become financial disciplined, relieve their debt burden, increase their savings, and grow their businesses sustainably".

"Under the philosophy "Everyone Matters"; "Krai Mai Hen Rao Hen" the bank is committed to improve our community. We realize the value of small business and small people in society, no matter how small, no matter they are customers or non-customers, everyone deserve education in financial knowledge that is crucial for business improvement and survival. We want to build a better community and financial inclusion that is fair and sustainable," said Mr. Gunara.

For more about Thai Credit Bank's Tang To Know-how programme, please go to www.tcrbank.com, https://www.facebook.com/TangToknowhow or call 02-697-5454.

Source: ARIP