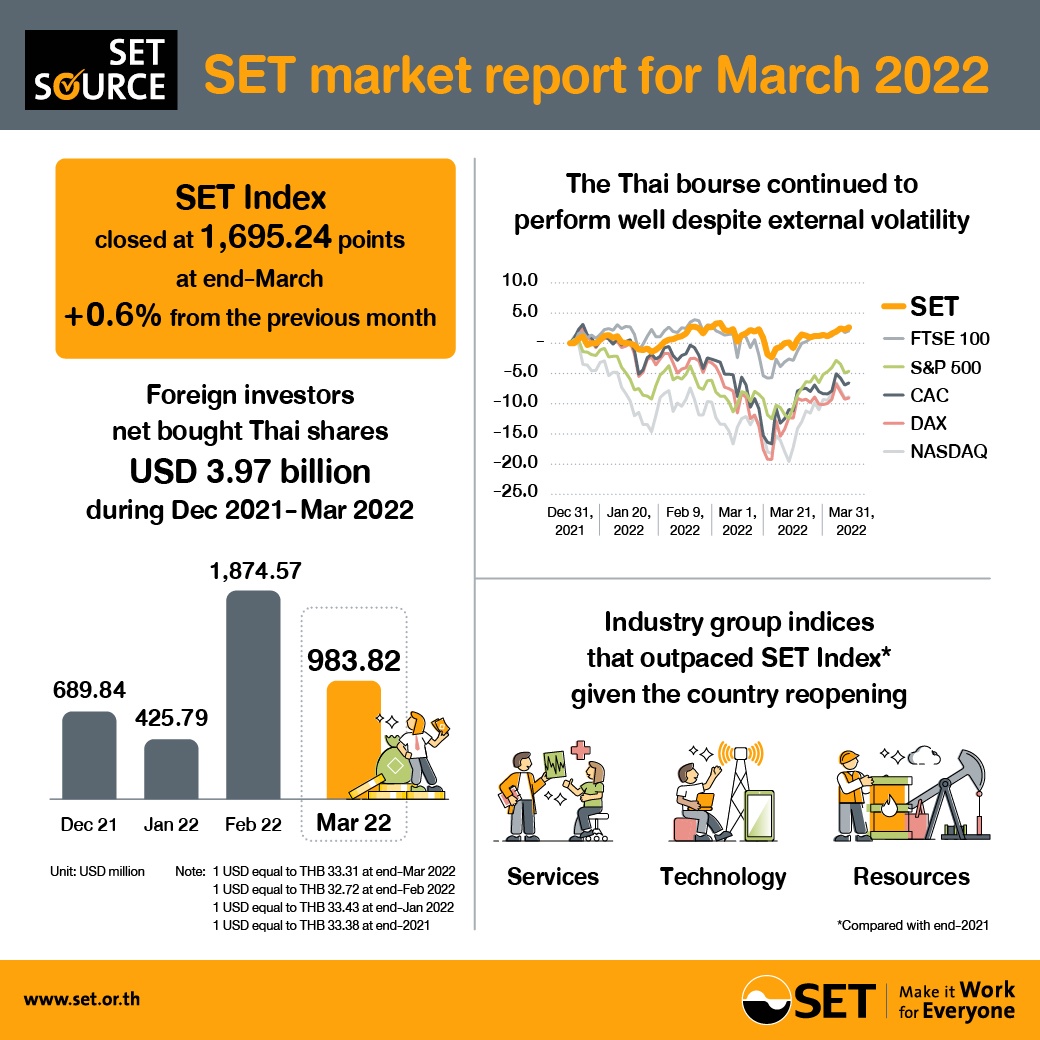

Stock Exchange of Thailand (SET) Senior Executive Vice President Soraphol Tulayasathien said that Thailand's exposure to Russia and Ukraine is considered limited as the economic rebound is gaining steam, particularly in the Services industry and tourism sector which are expected to reap a windfall from the country reopening in the near future. These factors have attracted foreign fund influx, with Thailand grabbing the biggest slice of capital inflows to ASEAN region during the first three months of 2022, and the SET Index closed 0.6 percent month-on-month higher at 1,695.24 points at end-March, or a 2.3 percent rise from end-2021.

Key highlights for March

- The SET Index ended March at 1,695.24 points, rising 0.6 percent from the previous month and 2.3 percent from end-2021, above average of other ASEAN exchanges.

- SET Index in the first quarter of 2022 was driven by industry groups which benefit from the country reopening, as such Services, Technology and Resources industry groups rose at a faster pace than the SET Index at end-2021.

- In March 2022, the average daily trading value of SET and mai amounted to THB 95.53 billion (approx. USD 2.87 billion), down 0.4 percent from the same period a year earlier, while the daily turnover in Q1/2022 averaged THB 96.24 billion. Foreign investors dominated trading value for two consecutive months, being net buyers of Thai shares with a net THB 32.77 billion in March, making net buying of THB 131.37 billion in total during the past four months (December 2021 - March 2022).

- In March 2022, BBGI pcl, a biomass and high value biomass product manufacturer, raised capital worth over THB 5 billion, ranking ASEAN's top five IPO deals in the first quarter of 2022.

- SET's forward P/E ratio was 17.6 times at end-March, exceeding the average ratio of its Asian counterparts at 12.3 times. The historical P/E ratio was 18.4 times, above the average ratio of other Asian markets at 16.0 times.

- The dividend yield ratio of SET was 2.63 percent at end-March, outpacing Asian stock markets' average ratio of 2.41 percent.

Derivatives market

- In March 2022, the derivatives trading volume averaged 701,944 contracts per day, up 14.2 percent from a year earlier, significantly driven by the higher trading volume of SET50 Index Futures, Single Stock Futures and Gold Online Futures. In Q1/2022, Thailand Futures Exchange PCL (TFEX)'s average daily trading volume rose 14.6 percent from the same period last year to 631,382 contracts.

Source: SET Corporate Communications