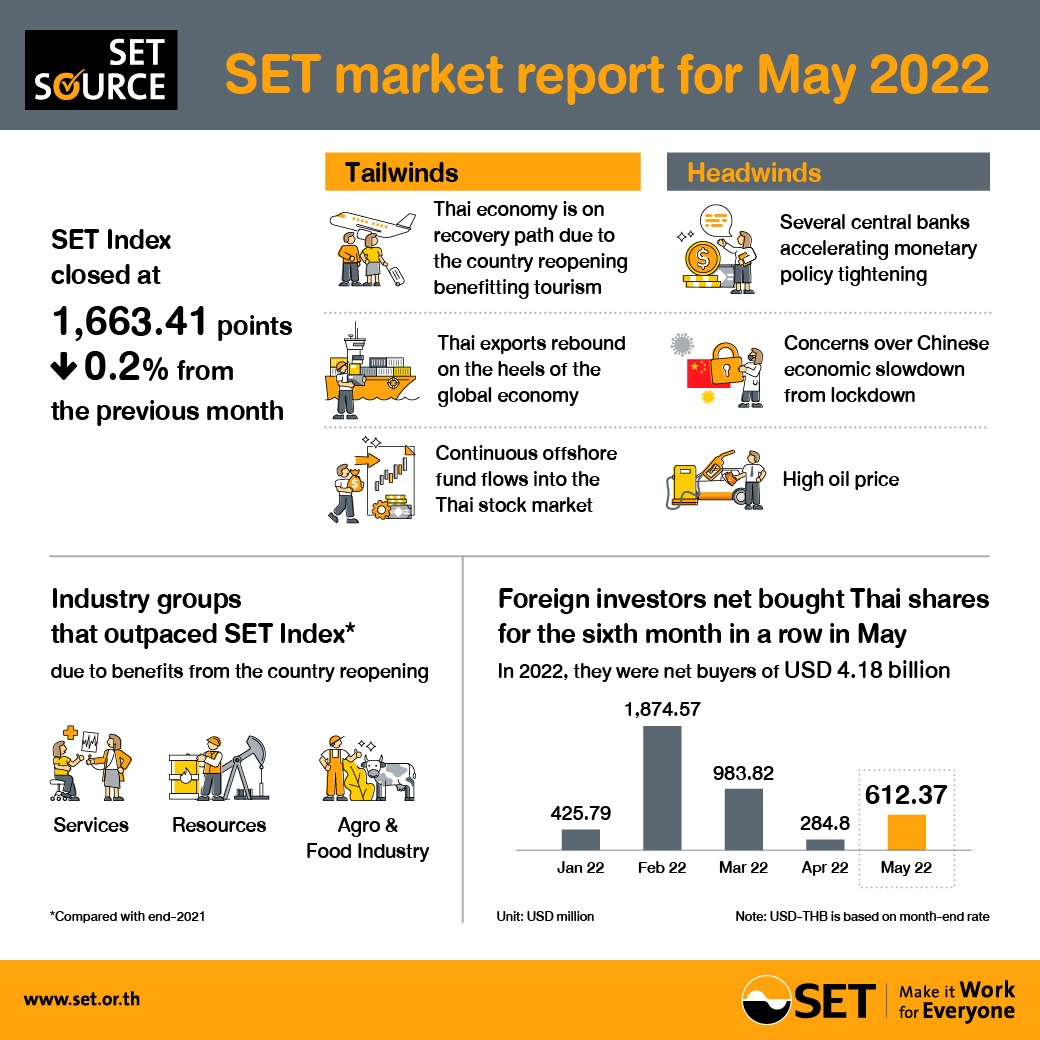

SET Senior Executive Vice President Soraphol Tulayasathien said that in the first five months of 2022, foreign investors shifted to the Thai stock market considerably due to the continuous export growth in line with the global economic recovery and the baht retreat as numbers of foreign tourists rose significantly after the government reopened the country. These positive factors helped limit the Thai stock market downside. SET Index was off just 0.2 percent from the previous month to 1,663.41 points at the end of May, but up 0.3 percent from the end of 2021 - above the regional average.

Key highlights for May

- SET Index ended May at 1,663.41 points, a 0.2 percent decline from the previous month. However, the benchmark index when compared with the end of 2021 rose by 0.3 percent, higher than regional average.

- In the first five months of 2022, SET Index was mainly driven by industry groups that benefited from country reopening, with Services, Resources and Agro & Food Industry industry groups outperforming SET Index comparing with end-2021.

- In May 2022, the average daily trading value of SET and Market for Alternative Investment (mai) was at THB 80.10 billion (approx. USD 2.33 billion), or a 26.8 percent drop from the same period a year earlier. In the first five months of 2022, the average daily trading value was at 90.70 billion. Foreign investors turned back to dominate trading value, accounting for 47.49 percent of total turnover. Foreign investors were net buyers of Thai shares for the sixth consecutive month in May with a net THB 20.94 billion. In the first five months of 2022, foreign investors bought a net THB 139.06 billion.

- In May, there were two new companies listed on SET: Royal Plus pcl (PLUS) and Function International pcl (FTI), and another two listed on mai: Knight Club Capital Asset Management pcl (KCC) and Bioscience Animal Health pcl (BIS).

- SET's forward P/E ratio was 17.3 times at end-May, exceeding the average ratio of Asian markets at 13.1 times. The historical P/E ratio was 18.5 times, higher than the average ratio of Asian markets at 13.9 times.

- The dividend yield ratio of SET was 2.69 percent at end-May, above Asian stock markets' average ratio of 2.64 percent.

Derivatives market

- In May 2022, derivatives daily trading volume averaged 472,021 contracts, or a 24.3 percent increase from the corresponding period a year earlier, mainly driven by trading in SET50 Index Futures and Single Stock Futures. In the five months through May of 2022, the average daily derivatives trading volume was 556,830 contracts, up 2.1 percent from the same period last year.

Source: SET Corporate Communications