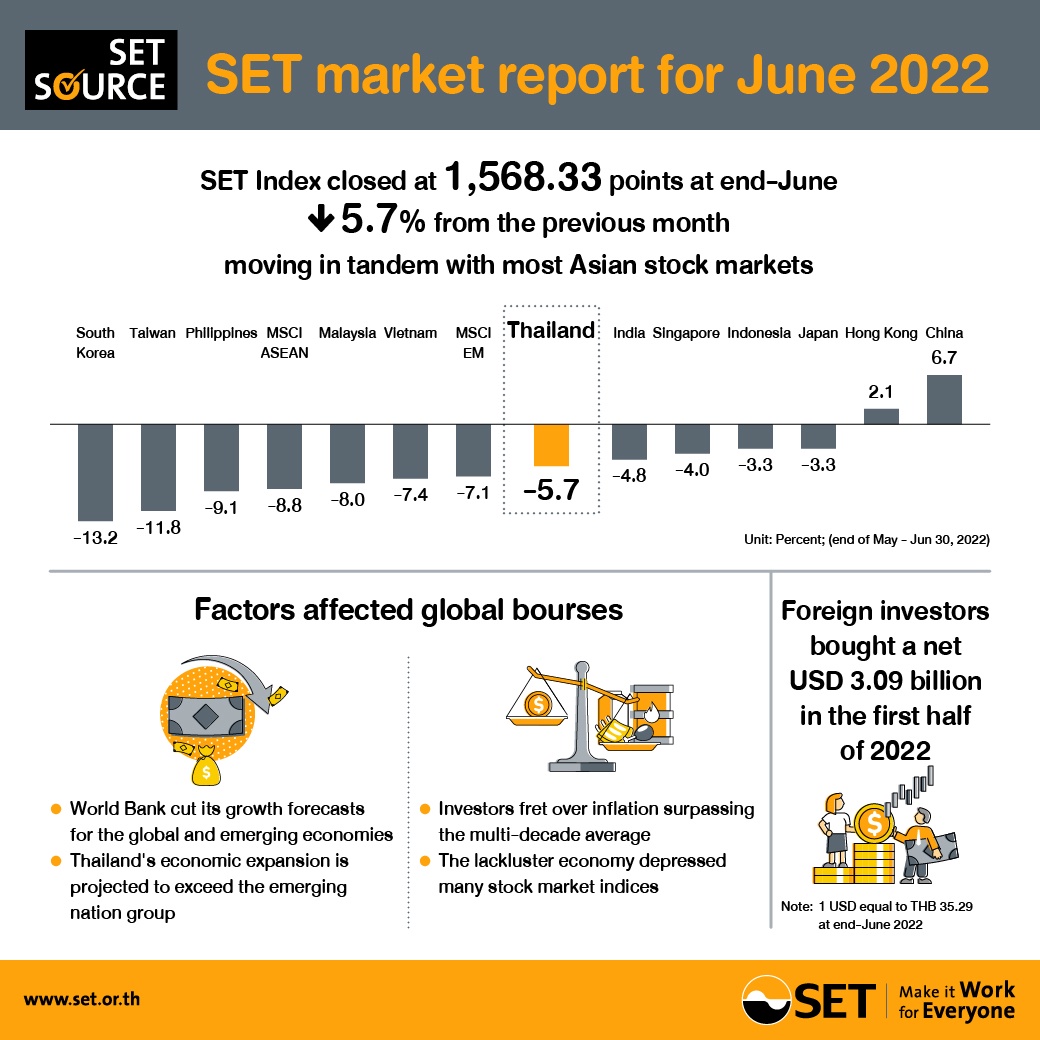

SET Senior Executive Vice President Soraphol Tulayasathien said that investors concerned over inflation which hit a record high in several decades with the sharp slowdown in global economic growth, intensifying stagflation risk. As a result, yields on many major stock exchange indices tumbled more than 20 percent from this year's record highs, entering a bear market, with the sign of consideration for increasing cash position in portfolios. At end-June 2022, SET Index closed at 1,568.33 points, or a 5.7 percent decrease from the previous month and a 5.4 percent decline from the end of 2021, comparatively less than the average of indices of other stock exchanges in the region.

Key highlights for June

- At the end of June 2022, SET Index closed at 1,568.33 points, down 5.7 percent from the preceding month and a meagre 5.4 percent from the end of 2021, less than the average of indices of other stock exchanges in the region.

- In the first six months of 2022, SET Index was driven by the industries that benefited from the country reopening. Compared to the end of 2021, the industries that outperformed SET Index were Services, Agro & Food Industry, Resources, and Property & construction industry groups.

- In June 2022, the average daily trading value of SET and mai amounted to THB 71.69 billion (approx. USD 2.01 billion), down 26.2 percent from the same month a year earlier. In the first half of 2022, the daily trading value averaged THB 87.34 billion. Foreign investors sold a net THB 29.99 billion, marking this year's first month of withdrawal in June after being net buyers for the sixth consecutive month. However, they remained net buyers of THB 109.07 billion during the January-to-June period.

- In June 2022, there was one new listed company on SET: Teka Construction pcl (TEKA); and another one new listed company on mai: Sahathaiprinting & Packaging pcl (STP).

- The Thai stock exchange's forward P/E ratio at end-June 2022 was 16.1 times, above the Asian stock markets' average of 12.4 times. The historical P/E ratio stood at 16.8 times, higher than the Asian stock markets' average of 13.0 times.

- Dividend yield ratio at end-June 2022 was 2.87 percent, slightly below the Asian stock markets' average of 2.89 percent.

Derivatives market

- In June 2022, Thailand Futures Exchange (TFEX)'s average daily trading volume recorded at 638,943 contracts, an increase of 35.4 percent from the same month last year, mainly driven by the increase in Single Stock Futures and SET50 Index Futures. For the first six months of 2022, TFEX's average daily trading volume totaled 571,320 contracts, or a 1.6 percent increase from the same period a year earlier.

Source: SET Corporate Communications