Fed's policy rate hikes increase global financial costs and strengthens the US dollar which, in turn, could derail recovery of other countries where their economies are still in state of fragile, and unable to withstand the volatility of capital flows mounting to liquidity problems and increasing credit risks.

The Stock Exchange of Thailand (SET)'s Senior Executive Vice President Soraphol Tulayasathien said that the IMF estimated Thailand's GDP growth would pick up to 2.8 percent this year and 3.7 percent in 2023 due to the return of foreign tourists in the second half of 2022 and further recovery next year. Notably, it also predicted that inflation would slow down to near the Bank of Thailand's target in 2023 due to a gradual ease of supply-side pressure in line with the softer commodity prices and limited demand-side pressure. As a result, the overall economy and the Thai stock market have remained robust. As of the end of October 2022, SET Index increased in tandem with other indices in the region.

Key highlights for October

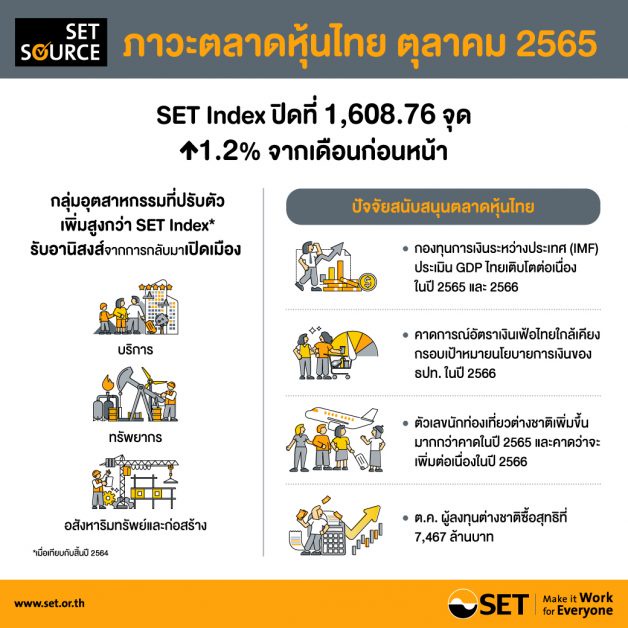

- At end-October 2022, SET Index closed at 1,608.76 points, up 1.2 percent from the previous month, moving in the same direction as indices of the counterparts in the region. Compared to end-2021, SET Index decreased by 2.9 percent.

- In the first 10 months of 2022, SET Index was propelled by the industries that benefited from the country reopening. Compared to end-2021, the industries that outperformed SET Index were Services, Resources, and Property & Construction industry groups.

- In October 2022, the average daily trading value of SET and Market for Alternative Investment (mai) amounted to THB 64.04 billion (approx. USD 1.68 billion), or a 27.5 percent fall from the same month a year earlier. For the January-to-October period, the average daily trading value recorded at THB 80.21 billion. Foreign investors were net buyers of THB 7.47 billion, resulting in foreign investors buying a net of THB 153.93 billion in the first 10 months of 2022. Foreign investors controlled the biggest slice of trading value for the six consecutive months.

- In October 2022, there was one new listed company on SET, namely Precise Corporation pcl (PCC), and three new companies on mai: Twenty-Four Con & Supply pcl (24CS), Asia Medical and Agricultural Laboratory and Research Center (AMARC), and International Network System pcl (ITNS). The Thai stock market is among Asia's top initial public offering (IPO) venue in terms of total fundraising value

- The Thai stock exchange's forward P/E ratio at end-October 2022 was 15.3 times, higher than the Asian stock markets' average of 11.5 times. The historical P/E ratio stood at 15.2 times, above the Asian stock markets' average of 10.4 times.

- Dividend yield ratio at end-October 2022 was 2.83 percent, below the Asian stock markets' average of 3.41 percent.

Derivatives market

- In October 2022, Thailand Futures Exchange (TFEX)'s average daily trading volume was 512,031 contracts, a 24.4 percent drop from the previous month, resulting from the decline in trading volume of Single Stock Futures. During the first 10 months of 2022, TFEX's average daily trading volume rose 1.3 percent on year to 559,866 contracts.

Source: SET Corporate Communications