Tana Pothikamjorn, Chief Executive Officer of KASIKORN LINE Co., Ltd., stated: "Over the past five years, LINE BK has facilitated financial convenience for Thai people by showcasing the concept of 'Banking in Your Hand.' Whether opening saving accounts, scanning QR codes for payments, applying for loans, saving money, or purchasing insurance—everything can be done within a LINE app. We currently serve over 8.2 million trusted customers and will continue advancing to become a true everyday financial partner for Thai people."

Standing by Thai People Through Every Crisis

Since LINE BK's launch, which coincided with Thailand facing the COVID-19 crisis, economic uncertainty, political instability, and rising living costs, LINE BK has stood firmly alongside Thai people through adversity with policies and support designed to help customers overcome crises and recover with stability including:

- Offering installment discounts and debt restructuring options for those impacted by various circumstances —including natural disasters situations such as floods and earthquakes, as well as unrest along Thailand-Cambodia border. LINE BK also provides support in alignment with government initiative such as the 'You Fight, We Help' program.

- Lending Responsibly, including providing financial education to encourage customers to borrow only necessary and affordability to repay from authorized lenders while avoiding over-indebtedness and enabling financial recovery.

- Increasing credit limits for customers with good payment histories, helping expand access to capital and ease daily financial burdens.

Three Key Dimensions Driving LINE BK

Throughout 5 years, LINE BK has developed services to make financial matters easy, accessible, and comprehensive across three core dimensions:

- Seamless in LINE - All Financial Matters in One Place

Complete all transactions including saving account opening, transfers, QR code payments, loan applications, and insurance purchases 24/7 through a single LINE app—no need to visit branches or switch between multiple apps.

- Inclusive Finance - Open to All Occupations

Making financial services easily accessible to everyone, especially through authorized lenders. Access is not limited to salaried employees but is extended to freelancers and individuals with lower income—reducing barriers and expanding financial opportunities for the majority of Thais.

- Comprehensive Solutions - Complete Coverage for Every Need

Developing products that cover daily banking transactions (Banking), enhancing liquidity through credit line facilities (Lending), and providing life and health protection through a variety of insurance plans (Insurance) to build both short-term and long-term financial security.

LINE BK's Growth Trajectory

- Complete Financial Transactions within LINE

Convenient, secure, and available 24/7—whether opening online saving accounts, applying for a debit card or transferring and or requesting money directly through chat.

- Loans for All Income Groups

Credit Line and Nano Credit Line services are designed to enhance liquidity for low-income earners and freelancers. Key features include no salary slip required and 1- minute approval* (for KBank customers with at least 6 months of continuous deposit account activity).

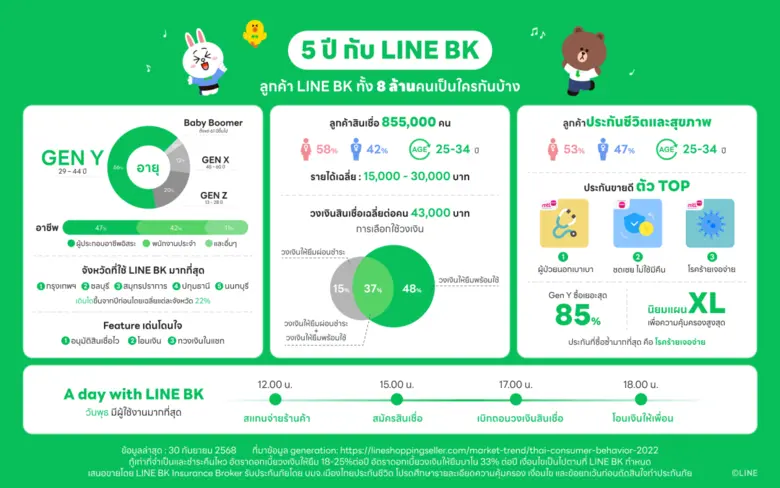

Currently, LINE BK serving over 855,000 loan customers, nearly half of the self-employed customers who have applied for loans with LINE BK earn less than 15,000 Thai Baht per month—a segment typically facing limitations in accessing traditional credit. To further promote financial inclusion, LINE BK is preparing to launch a new "Member Get Member" referral program, allowing existing lending customers to recommend loan products based on their actual experiences, with referrers receiving cash-back credits subject to terms and conditions. The initiative aims to promote responsible access to formal financial sources and reduce reliance on informal lending. Additionally, LINE BK partnered with LINE MAN Wongnai to streamline loan access for merchants on the platform, helping them gain easier access to funding and improve financial flexibility.

- Insurance Product, Covering Life, Health, and Savings Protection

LINE BK Insurance Broker continues to grow by, expanding its offerings to meet evolving customer needs with more comprehensive products such as "Having Debts, No Worries" —a life insurance plan designed for individuals with debt obligations, helping reduce worries of financial burden to the family if the unexpected event happens. The majority of customers segment belong to Gen Y, which approximately 85% of customers. This segment strongly prefer the XL plans that offer maximum coverage and frequently making repeat purchases to further increase their overall coverage. The best-selling products, including: "OPD Bao Bao" provided protection for outpatient department (OPD), "Chot-Choei Mai Chai Mee Khuen" a hospital benefit insurance product (HB), and "Rokrai jer jai" offering customizable critical illness (CI).

User Behavior Insights

Data shows Wednesday leads the week in transaction volume, with LINE BK users actively engaging throughout the day, especially during afternoon-to-evening hours—a reflection of urban lifestyle patterns. Usage peaks at lunchtime for QR code payments at stores, continues through the afternoon with loan applications and credit withdrawals, and culminates in the evening with the highest money transfer activity. This demonstrates LINE BK's success as a comprehensive all-in-one financial platform.

Advancing Toward "Everyday Financial Partner"

Entering its 6th year, LINE BK aims to fully develop as an Everyday Financial Partner, bridging financial and social life closer together—not just managing personal finances, but enabling friends and family to easily share, recommend, and pass along good things within a single LINE app.

The company will leverage the strengths of LINE ecosystem particularly through key partnerships such as LINE MAN Wongnai, combined with KASIKORNBANK'S deep understanding of retail customers powered by AI technology and responsible data usage, to create agile digital financial services that integrate financial management as a true part of daily life and lay the foundation for a new era of digital finance in Thailand.

Tana concluded: "We want LINE BK to be more than a financial service—to be a trusted financial companion in daily life, earning Thai people's trust every day, helping everyone manage finances with stability and growth, and continuously share good things with those around them."

*Borrow only necessary and affordability to repay. Interest rates for Credit Line is 18%-25% per year, and Nano Credit Line is 33% per year.

**LINE BK Insurance Broker operates as a life insurance brokerage. Insured by Muang Thai Life Assurance PCL.

Warning: Please study policy coverage, conditions, and exclusions information before deciding to purchase insurance.