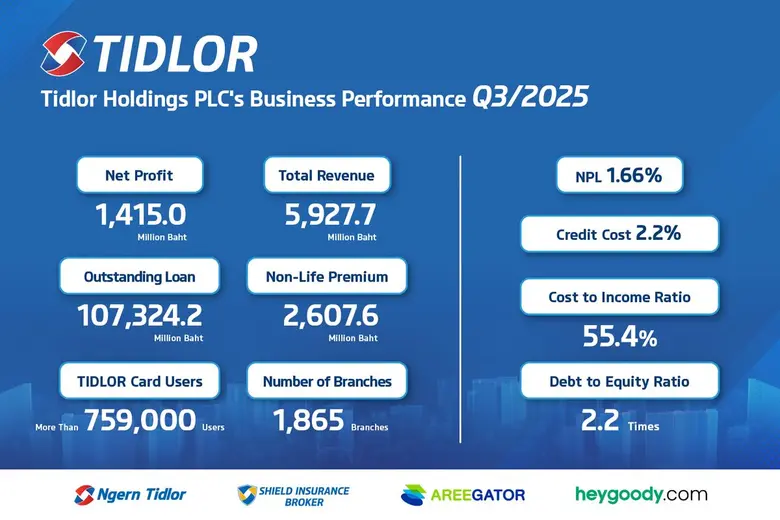

Tidlor Holdings Public Company Limited ("TIDLOR" or the "Group"), represented by Miss Cholthicha Thongthai, Chief Financial Officer (CFO), announced that for the third quarter of 2025 the Group reported a net profit of 1,415 million baht, increasing 43.0% (YoY) and 8.5% (QoQ), marking a new record high for quarterly performance. Total revenue amounted to 5,927.7 million baht, rising 5.7% (YoY), driven by continued expansion of the total outstanding loan portfolio and higher fee and service income from the insurance brokerage business. Total expenses were 4,157.1 million baht, reducing 4.9% (YoY), mainly due to a decrease in credit cost.

Insurance segment delivers growth ahead of industry

In 3Q/2025, the insurance brokerage business reported non-life insurance premiums of 2,607.6 million baht, an increase of 9.7% YoY. This growth was driven by a comprehensive product range and multi-channel distribution, including "Shield Insurance Broker" the leading face-to-face insurance brokerage brand, combined with the strength of its InsurTech platform through the brands "Areegator" and "heygoody.com". These brands expand customer reach and fill market gaps across segments, making fee income from insurance brokerage one of the Group's key growth drivers.

Loan growth sustained; NPL at 1.66%, industry low

The Group's outstanding loan portfolio amounted to 107,324.2 million baht, growing 4.5% YoY and 1.3% QoQ, driven by the sustained expansion of the vehicle title loan portfolio. The number of loan customers rose 9.6% YoY, reflecting quality growth under a prudent lending policy. Growth came from both its nationwide network of over 1,800 branches and digital financial solutions such as the Tidlor Card — a revolving cash card enabling customers to withdraw cash up to their loan limit via ATMs — and the E-Withdrawal feature on the NTL application, which has seen a consistent uplift in adoption.

Asset quality remained under control with the non-performing loans (NPL) ratio falling to 1.66% from 1.78% in the previous quarter — the lowest in the industry — supported by careful credit underwriting, high-quality new loan origination, and effective debt collection initiatives such as the government-supported program "You Fight, We Help." The NPL coverage ratio rose slightly to 283.9%, while credit cost declined to 2.2% from 3.9% a year earlier.

For the first nine months of 2025, the Group reported a total net profit of 3,924.5 million baht, increasing 23.2% YoY, driven by a 5.7% YoY increase in total revenue, effective credit quality management, and disciplined cost control. The Group maintained a strong capital structure and solid liquidity to support long-term business growth and continued diversification through its insurance brokerage business, focusing on delivering quality growth across the organization.

Strong financial position supports sustainable growth alongside Thai people

Mr. Piyasak Ukritnukun, Managing Director, stated that the management team continues to drive sustainable and quality growth across Tidlor Holdings, powered by its two core business engines — the vehicle title loan business and the insurance brokerage business. The Group leverages its financial technology capabilities and InsurTech platform as key enablers to support growth and strengthen revenue generation across business units.

Amid the current economic uncertainty in Thailand, household income volatility continues to affect financial liquidity, while tighter credit conditions have limited lending capacity among many financial institutions. Leveraging its strong capital base, ample liquidity, and healthy balance sheet, Ngern Tid Lor Public Company Limited — a key subsidiary under Tidlor Holdings — launched a special interest rate reduction campaign, cutting vehicle title loan rates from 24% to 19% per annum for car and pickup loans during October 20 to December 31, 2025. This initiative aims to ease financial burdens and improve access to funding for Thai borrowers, reflecting Ngern Tidlor's continued commitment to creating financial opportunities and serving as a trusted financial partner that helps people "Life Rolls Forward"

Tidlor Holdings and its subsidiary remain steadfast in their vision to become The Leading Financial Inclusion Service Provider, empowering underserved Thais with fair, transparent, and accessible financial solutions that enhance their quality of life. The Group continues to promote financial literacy and create long-term positive social impact through sustainable growth initiatives.

For further information for shareholders and investors, please visit www.tidlorinvestor.com