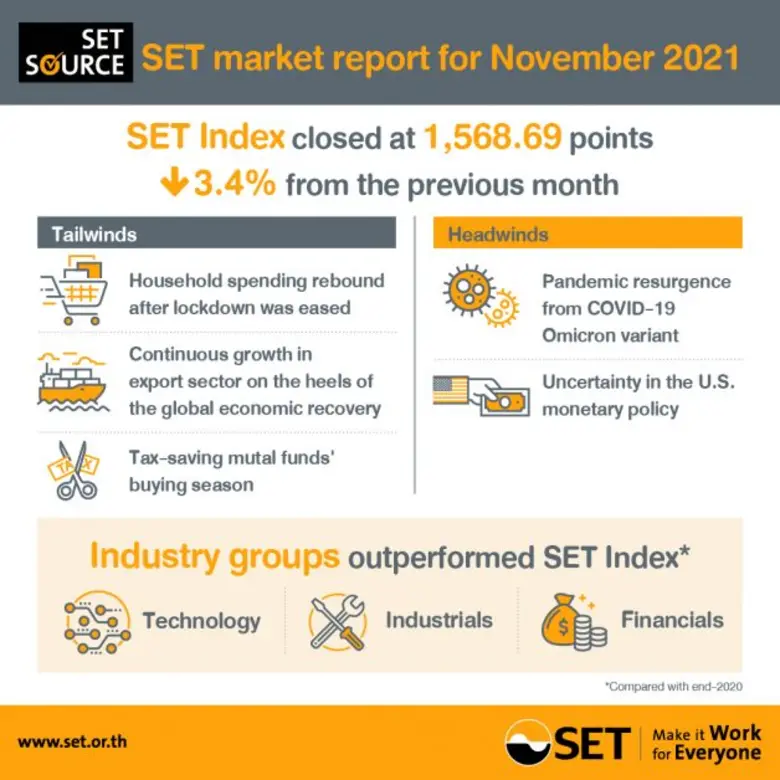

Stock Exchange of Thailand (SET Senior Executive Vice President Soraphol Tulayasathien said that at end-November SET Index closed at 1,568.69, a 3.4 percent decrease from the previous month. The benchmark index, however, gained 8.2 percent from the end of 2020, outpacing average index of other regional exchanges. The industry groups that surpassed the SET Index were Technology, Industrials and Financials, compared to year-end 2020.

Key highlights for November

- SET Index ended November at 1,568.69 points, down 3.4 percent from a month before, but rising 8.2 percent from end-2020 outperforming other regional average.

- Compared with the year-end 2020, most industry groups rose, with Technology, Industrials and Financials industry groups outpacing SET Index, compared to end-2020.

- In November, the average daily trading value of SET and Market for Alternative Investment (mai) rose 2.4 percent from the same period a year earlier to THB 92.28 billion (approx. USD 2.73 billion). The average daily trading value for the first 11 months was THB 95.34 billion.

- Foreign investors turned to net sellers for the first month in November with a net THB 10.18 billion after being net buyers for three consecutive months. For the first 11 months, foreign investors were net sellers at THB 73.58 billion, while local investors were net buyers of THB 128.84 billion. Since the COVID-19 pandemic started in February 2020, local investors have continuously dominated trading value ratio.

- In November, IPO activities continued with two new companies and one real estate investment trust (REIT) listed on SET, as well as two new companies listed on mai. During the first 11 months of this year, the fundraising value via IPOs in the Thai bourse was higher than any other stock markets in ASEAN-5.

- SET's forward and historical P/E ratios were 18.3 times and 18.9 times respectively at end-November, above the average ratios of Asian markets at 15.0 times and 17.1 times respectively.

- Dividend yield ratio of SET was 2.84 percent at end-November, higher than Asian stock markets' average ratio of 2.45 percent.

Derivatives market

- In November, Thailand Futures Exchange (TFEX)'s derivatives trading volume averaged 607,801 contracts per day, up 5.9 percent from the previous month. Notably, during the first 11 months of 2021, the average daily trading volume was 557,947 contracts, or an 18.1 percent rise from the same period a year earlier, mainly driven by trading in Single Stock Futures.