The financial service market landscape has been evolving every year with the direction of bundling financial products to enhance customer experience directly from non-financial company platforms. This movement is known as "Embedded Finance."

Embedded Finance is not a new concept. It has been around for many decades, with its original purpose of upselling and cross-selling. For example, lending or insurance is offered at car dealers. However, the rise of mobile technology, including 4G/5G networks and smartphones, has significantly increased the realization of this concept to become more convenient and accessible. Today, we can experience many embedded finance services/products in various e-commerce platforms like Buy Now Pay Later in the shopping platform and insurance buying from the travel booking platform, just to name a few.

"The expansion of Embedded finance continues and is expected to go beyond the smartphone. The possibilities are endless. More products are to be offered by various non-financial services players in various industries. With this movement, the financial services business model landscape will be diversified. Non-financial services companies will realize increasing revenue portion from the bundling financial product in their platforms." says Mr. Takeshi Nozawa, Principal and Head of Financial and Social Infrastructure of ABeam Consulting Thailand

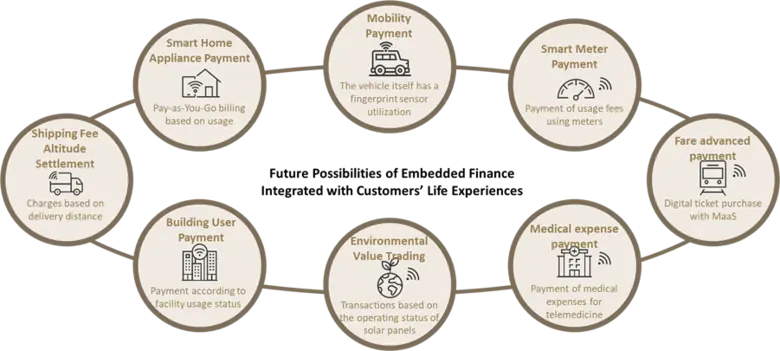

From ABeam Consulting's study, we foresee the trend in payment products to cover almost all purchasing value transactions and types (from small to big purchases, from daily buying to non-frequent buying). Lending product coverage is also extended to smaller purchasing transactions such as supermarket purchases, utility bills, etc. And no longer limited to smartphone devices, the new financial product will be enabled on various smart devices we interact with daily, such as cars, home appliances, office appliances, etc. Payment can be triggered from fingerprint sensors in the vehicle and Pay-As-You-Go or Pay-Per-Usage can be enabled from various smart devices with meter installation.