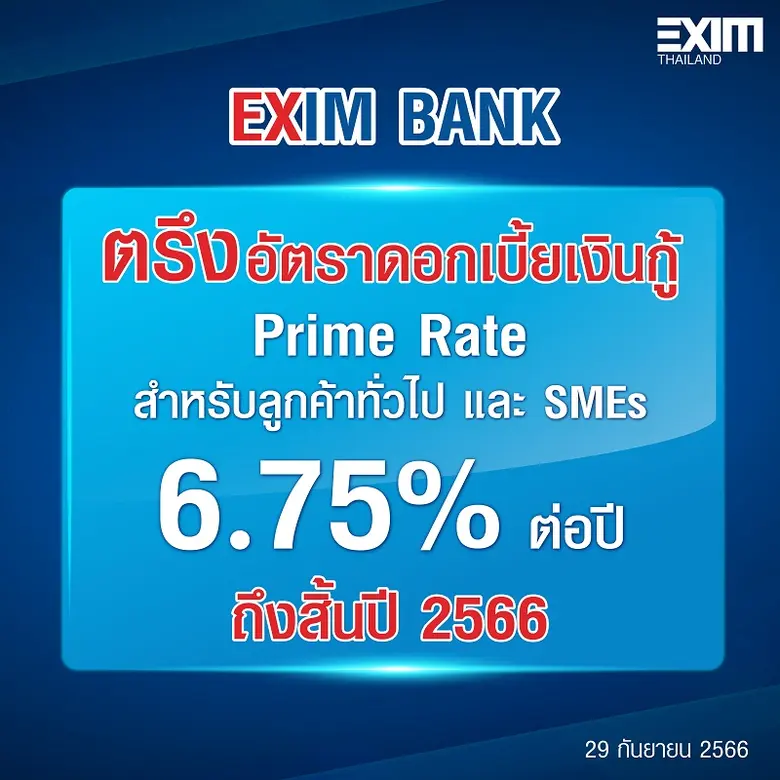

"As a specialized financial institution, EXIM Thailand remains resolute in its role as the Thailand Development Bank, with a firm determination to support both general customers and SME entrepreneurs by keeping interest rates unchanged. We are also actively advancing the development of financial products and tools to enhance business adaptability, enabling them to initiate or expand their ventures in the global market. This, in turn, will generate income, stimulate employment, foster economic growth within local communities and Thailand as a whole, and contribute to sustainable development amidst fluctuating economic conditions and rising interest rates," said Dr. Rak.