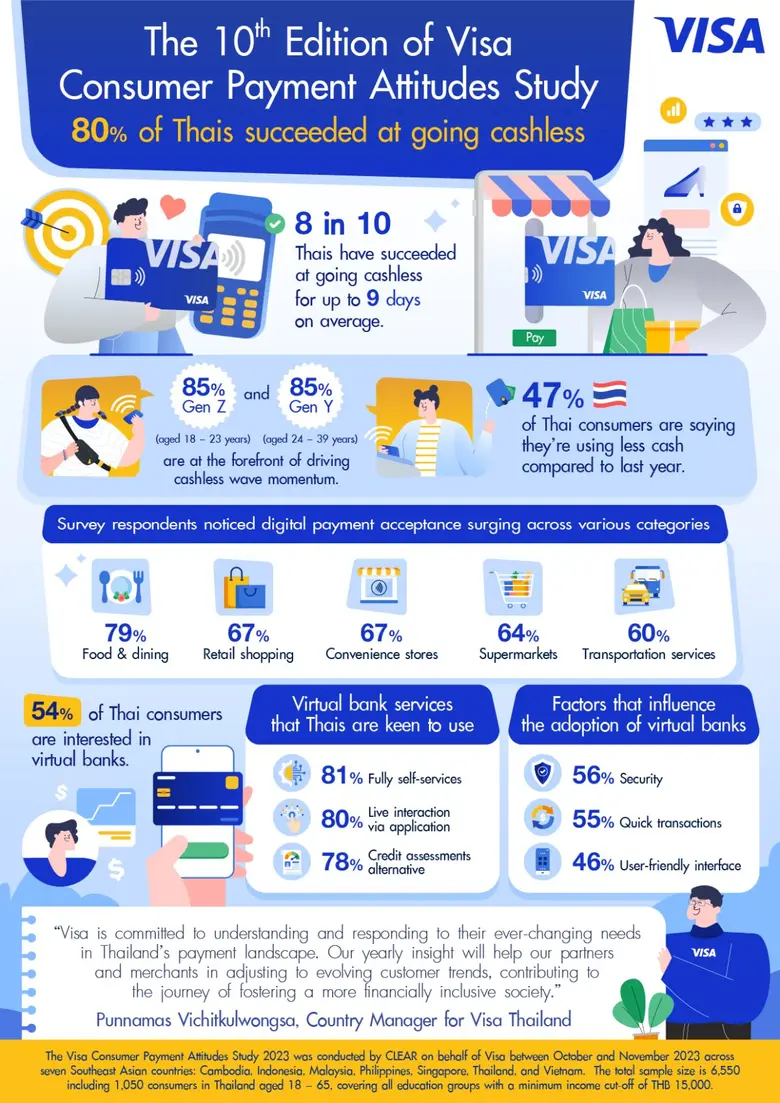

In addition, the study underscores the ongoing momentum of the cashless wave in Thailand, with eight in 10 consumers (81%) having attempted to go cashless. Younger consumers from the Gen Z (85%) [aged 18 to 23 years] and Gen Y (85%) [aged 24 to 39 years] segments lead this shift, with nearly four in five Thais successfully adopting cashless methods.

Punnamas Vichitkulwongsa, Country Manager for Visa Thailand said, "The cashless lifestyle trend in Thailand is very strong and this positive trend aligns with the global surge in cashless transactions and digital commerce, emphasising convenience, security, and the increasing acceptance of digital payment methods. This presents a clear opportunity for businesses to adapt and innovate, catering to the evolving needs of consumers."

The study also reveals that Thai consumers are increasingly confident in carrying less cash when going out, with nearly half (47%) reporting a decrease in cash usage compared to the previous year.

This trend is linked to the growing acceptance and usage of cashless payments in Thailand. According to the findings, respondents to the survey said they have noticed digital payment acceptance surging across various categories, particularly in food & dining (79%), retail shopping (67%), purchases at convenience stores (67%), supermarkets (64%), and transportation services such as taxis and ridesharing (60%).

As the country plans to introduce virtual banks to meet the demand of various customer sectors, the study also examined consumers' interest as well as services they were most interested to use provided by virtual banks. Based on the findings, virtual banking services have piqued the interest of more than half of Thai consumers (54%). Most of the interest come from Gen Y (68%) and Gen X (53%) segments. Top virtual bank services respondents are keen to use include fully self-services (81%), live interactions through digital application (80%), and utilising alternative financial data for credit assessments (78%).

When it comes to the most important factors for Thais when considering use of virtual banks, security emerges as the top priority, with 56 per cent of Thais placing priority on the need for a secure method of payment and transaction. This was followed by valuing quick transactions (55%) and a user-friendly interface with minimal clicks required (46%).

"The ongoing shift of Thai consumers towards a cashless society reaffirms Visa's commitment to understanding and responding to their dynamic needs in Thailand's payments landscape. Our annual insights will help our partners and merchants tailor solutions to support the needs of customers, which would help them support Thailand's journey towards becoming a more financially inclusive society," concluded Punnamas.

[1] The Visa Consumer Payment Attitudes Study 2023 was conducted by CLEAR on behalf of Visa between October and November 2023 across seven Southeast Asian countries: Cambodia, Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam. The total sample size is 6,550 including 1,050 consumers in Thailand aged 18 - 65, covering all education groups with a minimum income cut-off of THB 15,000.